Potential Role for “Clinically Nuanced” V-BID Plans in Private Exchanges

Growth in Private Exchanges

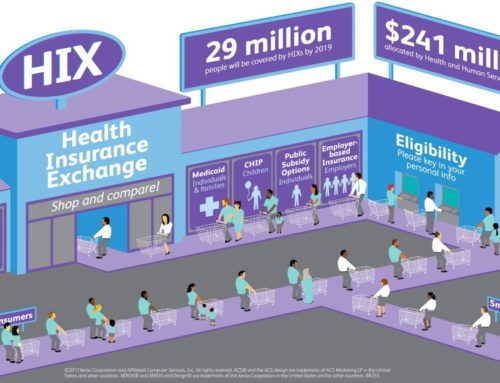

Employers are increasingly challenged to offer competitive benefits that attract and retain talent while simultaneously control employee health care costs. While private exchanges have existed for over a decade, these health insurance marketplaces have recently gained popularity as an innovative tool to help employers deal with these conflicting priorities. Over 1.7 million individuals with employer-sponsored coverage enrolled via a private exchange in 2014; this number is projected to increase to 40 million enrollees by 2018.1

In traditional employer-sponsored coverage, most large employers are self-insured and contract with third-party administrators (TPA) to deliver defined health benefits to their beneficiaries. Historically, this approach has yielded unpredictable and sometimes substantial increases in health care spending that has enticed employers to seek alternative models. In the defined contribution model, employers cap the amount they spend per employee and can more reliably project expenditures. Private exchanges have facilitated this transition, as employers can provide employees a fixed amount of money to purchase a plan on an online marketplace that is within their budget and meets their healthcare needs. Walgreens, Sears, and Aon Hewitt are among the large employers that have led the migration to private exchanges; small and mid-size employers are anticipated to follow suit as the employer mandates under the ACA are implemented.2 However, the risk of this approach is that health benefit enrollees may ‘buy down’ their coverage. Should these underinsured individuals develop a significant illness, they may be less prepared to accept the associated financial burden, resulting in substantial financial distress.

The Impact of Competition on Employees

Two common models for private exchanges are single carrier exchanges and multi-carrier exchanges. A single carrier exchange offers an array of plan design options from one health plan. This approach tends to give employers more control over which options to include in their benefit offerings for employees. Conversely, multi-carrier exchanges are typically run by a third party intermediary with less employer involvement, and they offer insurance plan options from multiple health plans.3 Both models increase market competition with the intent to increase plan choice and lower premiums. Single carrier exchanges must maintain competitive premiums in order to obtain desirable employer contracts. Similarly, insurers participating on multi-carrier exchanges must offer affordable premiums to attract price sensitive consumers. A third type of private exchange offering is a ‘quilted’ network that incorporates those health plans offering the greatest network discounts by geographic region, optimizing near-term cost savings and, as a result, generating value for employers.

Two common models for private exchanges are single carrier exchanges and multi-carrier exchanges. A single carrier exchange offers an array of plan design options from one health plan. This approach tends to give employers more control over which options to include in their benefit offerings for employees. Conversely, multi-carrier exchanges are typically run by a third party intermediary with less employer involvement, and they offer insurance plan options from multiple health plans.3 Both models increase market competition with the intent to increase plan choice and lower premiums. Single carrier exchanges must maintain competitive premiums in order to obtain desirable employer contracts. Similarly, insurers participating on multi-carrier exchanges must offer affordable premiums to attract price sensitive consumers. A third type of private exchange offering is a ‘quilted’ network that incorporates those health plans offering the greatest network discounts by geographic region, optimizing near-term cost savings and, as a result, generating value for employers.

While creating near-term cost savings for employers, a more competitive marketplace can have a mixed impact on employees. Plans with lower premium costs, by their nature, lead to an increase in out-of-pocket spending. For example, many employers are opting for high deductible health plans (HDHP), which have appeal to employees due to their low upfront costs. However, HDHPs also impose high cost-sharing responsibilities. Early private exchange data shows that consumers enrolled in HSA-Eligible HDHP plans at a rate of 40-60%, substantially more than the roughly 20% enrollment rate seen nationally outside of such exchanges.4

For employers, there is a measurable and substantial risk with this approach. While healthcare costs may stabilize or even decrease in the setting of liberal enrollment in HDHPs, at least part of the observed cost impact is the result of a reduction in use of appropriate healthcare services, resulting in less well managed chronic conditions. Consequently, employers may appreciate greater illness-related absences and decreased on-the-job productivity (presenteeism). Additionally, financial stress resulting from medically-related financial debt may generate further workplace distraction and productivity impairment. Taken together, a broad view of health related outcomes should be considered in addition to insurance expenditures. The following figure shows the additional impactors that employers should consider when implementing benefit designs. The potential concerns of cost-related non-adherence may be mitigated with the integration of user-friendly consumer plan selection tools and plans incorporating Value-Based Insurance Design (V-BID).

Implementing V-BID in Private Exchanges

The growth and flexibility of private exchanges has significant potential to enhance consumer access to plans incorporating the principles of Value-Based Insurance Design (V-BID). The basic premise of V-BID is to align patients’ out-of-pocket costs including copayments, coinsurance, and deductibles with the clinical value — not cost — of clinical services. These innovative products are designed with the tenets of “clinical nuance” in mind. These tenets recognize that 1) medical services differ in the amount of health produced, and 2) the clinical benefit derived from a specific service depends on the consumer using it, as well as when and where the service is provided. By reducing barriers to high-value treatments (through lower costs to patients) and discouraging low-value treatments (through higher costs to patients), these plans can improve access to recommended services and, ultimately, patient health outcomes.

As employers shift to a private exchange model, they should consider the inclusion of plans incorporating VBID principles, particularly as many exchange options include plans with increased cost shifting to employees. Evidence is accumulating that certain V-BID features are effective in reducing cost-related non-adherence.5 These include reducing the level of cost-sharing, targeting high-risk individuals, and offering concomitantly with a wellness program. In addition to cost-sharing reductions for targeted services or providers, other V-BID elements may include premium reductions for healthy behaviors, deductible waivers, HSA contributions, access to enhanced benefits or programs, and other financial rewards (such as gift cards or raffle entries). Moreover, private exchanges can add value by offering plans that use benefit design to steer consumers to high performing providers, such as those in patient-centered medical homes, high performance networks, or accountable care organizations.

Consumer Support Tools

A private exchange can be especially valuable for individuals with chronic illness to help them manage their health by highlighting plans that best match their medical needs and assisting them with navigating benefit offerings. Once a plan option has been selected, some exchanges may provide ongoing tools and resource support to identify high quality, cost-effective primary care and specialist clinicians.6 Another V-BID tactic might include offering an incentive to promote use of these healthcare consumerism tools.

Private Exchanges and V-BID – Clear Synergies

In many instances, individuals do not choose a health plan that best meets their clinical and financial needs. Instead, consumers often select a low-premium option – even though that plan may lead to higher out-of-pocket spending and may prompt avoidance of evidence-based care as a result of financial strain. The growth of private exchanges provides ample opportunities to design and implement clinically nuanced V-BID plans that engage consumers and improve patient-centered outcomes by reducing the likelihood of cost-related non-adherence. Private exchanges with a range of plan options, coupled with user-friendly tools that guide individuals in choosing the “right” plan, will be a boon to consumers as well as employers looking to provide consumer choice, maintain workforce health and productivity, and better manage health care expenditures.

* The V-BID Center gratefully acknowledges Bruce Sherman, MD, for his thoughtful contributions to this issue brief.

Citations:

2

5http://www.content.healthaffairs.org/content/33/3/493.abstract