Originally Produced: June 2013 Updated: January 2019

Implementing Value-Based Insurance Design in Medicare Advantage

Introduction

Due to misaligned incentives, Medicare beneficiaries currently receive too little high-value care and too much low-value care. Value-Based Insurance Design (V-BID) is an innovative approach that can address this problem when implemented correctly. The basic premise of V-BID is to align consumer incentives with value by reducing barriers to high-value health services and providers (‘carrots’) and discouraging the use of low-value health services and providers (‘sticks’). When ‘carrots’ and ‘sticks’ are used in a clinically nuanced manner, V-BID improves health care quality and controls spending growth. The concept of clinical nuance recognizes that 1) medical services differ in the amount of health produced, and 2) the clinical benefit derived from a specific service depends on the consumer using it, as well as when, where, and by whom the service is provided.

Encouraging Medicare Beneficiaries to Use High-Value Services and Providers: The Case for V-BID

Transitioning from a volume-driven to value-based delivery system requires a change in both how we pay for care (supply-side initiatives) and how we engage consumers to seek care (demand-side initiatives). For example, cost-sharing for all clinician visits, diagnostic tests, and prescription drugs is typically implemented in a ‘one-size-fits-all’ way. Under the fee-for-service (FFS) Medicare program, this is the required approach. A growing body of evidence demonstrates that increases in patient cost-sharing lead to decreases in the use of both non-essential and essential care. Peer-reviewed studies reveal that when patients are asked to pay more for high-value cancer screenings and potentially life-saving drugs, they use significantly less of these services. Conversely, decreases in cost-sharing applied to all services – regardless of clinical benefit – may lead to overuse or misuse of services that are potentially harmful or provide little clinical value.

To encourage consumers to take advantage of high-value services and actively participate in decision making about treatments that are subject to misuse, private sector purchasers began to implement V-BID more than a decade ago. While the success of V-BID programs is well-established, there are opportunities and challenges to implementing V- BID in the Medicare program. Although the Medicare statute provides for coverage of certain preventive services identified by the U.S. Preventive Services Task Force (USPSTF) with zero cost-sharing, the fee-for-service (FFS) program allows little flexibility to implement clinically driven benefits. Specifically, program administrators are limited in their ability to lower cost-sharing levels for other services recommended in clinical guidelines. Moreover, the FFS program is unable to use benefit design to encourage patients to use high-value providers. Within a provider type, Medicare beneficiaries must pay the same regardless of which provider they choose. Though practice patterns and quality may vary across providers, the FFS program sets prices administratively, using methodologies that do not allow variation in price to align with variation in value. Unlike in the private sector, the FFS program is unable to incorporate clinically focused benefit design to promote better outcomes and greater efficiency.

BID in the Medicare program. Although the Medicare statute provides for coverage of certain preventive services identified by the U.S. Preventive Services Task Force (USPSTF) with zero cost-sharing, the fee-for-service (FFS) program allows little flexibility to implement clinically driven benefits. Specifically, program administrators are limited in their ability to lower cost-sharing levels for other services recommended in clinical guidelines. Moreover, the FFS program is unable to use benefit design to encourage patients to use high-value providers. Within a provider type, Medicare beneficiaries must pay the same regardless of which provider they choose. Though practice patterns and quality may vary across providers, the FFS program sets prices administratively, using methodologies that do not allow variation in price to align with variation in value. Unlike in the private sector, the FFS program is unable to incorporate clinically focused benefit design to promote better outcomes and greater efficiency.

In contrast, private health plans participating in Medicare Advantage (MA), have flexibility to use care management techniques to promote evidence-based care, including limited ability to adjust benefit design. The compendium of MA tools includes network formation, provider-facing interventions (e.g., bonuses for quality and high performance), and utilization management programs to identify under-utilization as well as over-utilization. From the consumer engagement perspective, however, MA plans could further enhance their ability to serve beneficiaries if they had greater ability to use benefit design to promote value.

V-BID in Medicare Advantage Model Overview

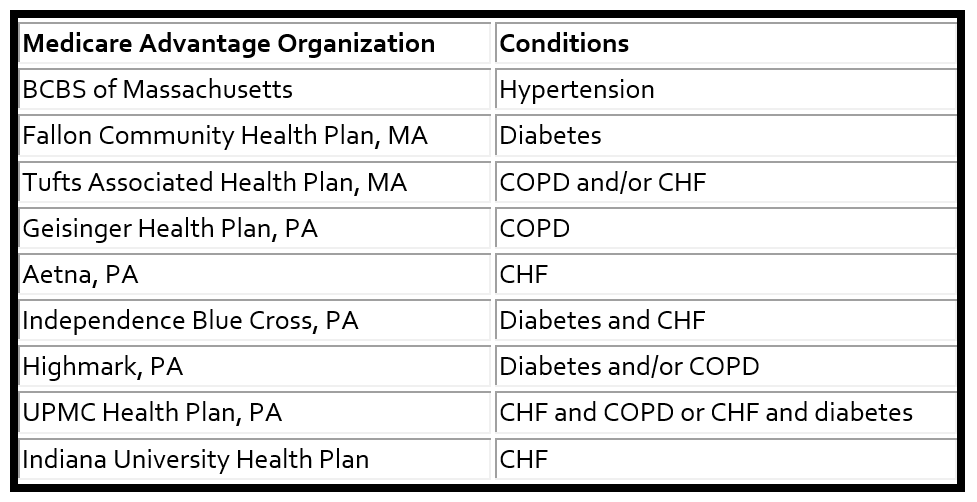

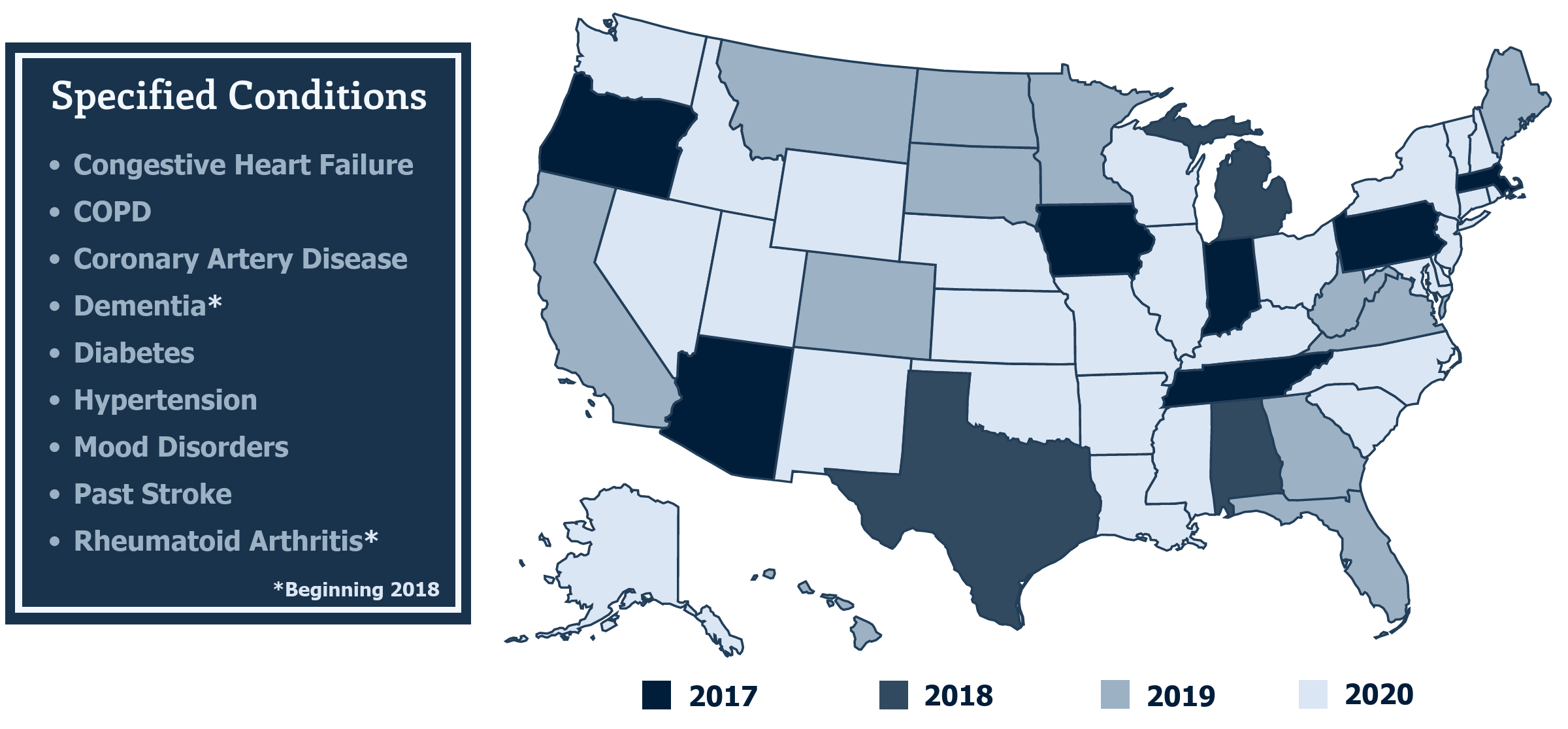

In September 2015, the Center for Medicare and Medicaid Innovation (CMMI) announced a program to test Value-Based Insurance Design in Medicare Advantage Plans. The MA-V-BID model test began on January 1, 2017. Initially, CMS planned for seven states to participate: Arizona, Indiana, Iowa, Massachusetts, Oregon, Pennsylvania, and Tennessee. Ultimately, nine plans in three states were selected to move forward with the test. Participating plans develop benefit designs for enrollees in the following seven chronic condition categories: diabetes, chronic obstructive pulmonary disease (COPD), congestive heart failure (CHF), patients with past stroke, hypertension, coronary artery disease, and mood disorders.

Additionally, participating plans are able to tailor specific interventions for groups that have multiple co-morbidities. In both cases, the interventions must be selected from four categories of plan design modifications.

V-BID Aspects Within the CMS Model

There are four main interventions in the Medicare Advantage Value-Based Insurance Design Model Test that are intended to move the Medicare program into the 21st Century by encouraging quality and containing cost growth:

Intervention 1: Reduced Cost-Sharing for High-Value Services

Participating organizations have the ability to reduce or eliminate cost-sharing for healthcare services that they have identified as high-value services for a given target population, as long as the services are clearly identified and defined in advance.

Intervention 2: Reduced Cost-Sharing for High-Value Providers

Organizations are allowed to reduce cost-sharing for high-value healthcare providers. Organizations can decide to reduce cost-sharing for any service that is provided by a high-value provider or to only reduce cost-sharing for a high-value service that is provided by a high-value provider. Either way, the organization must support their methodology for determining a high-value provider and are encouraged to emphasize the clinical rationale. CMS will review each individual proposal, but they will only accept proposals that they believe have acceptable criteria for selecting high-value providers. Organizations are encouraged to rely on independent, external metrics in their criteria.

Intervention 3: Reduced Cost-Sharing for Enrollees Participating in Disease Management or Related Programs

Participating organizations can reduce cost-sharing for healthcare services for enrollees who participate in a plan-sponsored disease management program. An example of this intervention is a reduction in primary care co-pays for patients with heart disease who regularly meet with a case manager. While organizations can base cost-sharing reductions on enrollees meeting certain milestones, they cannot base cost-sharing reductions on enrollees meeting certain physical checkmarks such as body-mass index.

Intervention 4: Coverage of Additional Supplemental Benefits

The last intervention allows organizations to offer supplemental benefits coverage to targeted populations with the goal of either reducing costs or improving outcomes. CMS will review the organization’s clinical rationale for offering the supplemental benefits to the targeted population. An example of this kind of intervention is a tobacco cessation program for enrollees with COPD.

Expansion of the MA V-BID Model Test

As of January 1, 2018 CMS expanded the model to Alabama, Michigan and Texas and included two additional clinical conditions: rheumatoid arthritis and dementia. Beginning in 2019, the V-BID model will include an additional fifteen new states for a total of 25 states, allow Chronic Condition Special Needs Plans to participate, and allow participants to propose their own systems or methods for identifying eligible enrollees.

Most recently, President Trump signed the Bipartisan Budget Act of 2018, which incorporates the CHRONIC Care Act that expands the CMMI Medicare Advantage Value-Based Insurance Design Model to all 50 states.

Increasing Plan Flexibility

In April 2018, the Centers for Medicare and Medicaid Services released a reinterpretation of the MA uniformity requirement to allow MA plans additional flexibility in their benefit designs for MA enrollees with specified chronic conditions.11 Beginning in 2020, MA plans outside of the V-BID model may offer their beneficiaries V-BID benefit designs for Medicare Part C without being subject to the additional application and geographic limitations of the current model. However, the ability to lower cost-sharing for Part D prescription drugs will remain unique to the V-BID model. The incorporation of clinically-nuanced V-BID strategies beyond the scope of the model test highlights enormous opportunity for the Medicare Advantage program.

V-BID 2.0: Updates to the Medicare Advantage V-BID Model

In January 2019, The Centers for Medicare and Medicaid Services (CMS) announced transformative updates to the MA V-BID model. By testing a wide range of MA service delivery and/or payment approaches, the MA V-BID model aims to increase choice, lower cost, and improve the quality of care for Medicare beneficiaries. Beginning in 2020, MA plans may:

- Provide reduced cost sharing and additional benefits to enrollees in a more targeted fashion than has previously been allowed, including customization based on chronic condition, socioeconomic status, or both, and even for benefits not primarily related to health care, such as transportation

- Bolster the rewards and incentives programs that plans can offer beneficiaries to take steps to improve their health, permitting plans to offer higher value individual rewards than were previously allowed

- Increase access to telehealth services by allowing plans to use access to telehealth services instead of in-person visits, as long as an in-person option remains, to meet a range of network requirements, including certain requirements that could not previously be fulfilled through telehealth

The MA V-BID model will be extended through 2024 and testing of Medicare’s hospice benefit in MA will begin in 2021. Special Needs Plans and Regional PPOs in all states and territories are now eligible to apply.

The MA V-BID model aims to assess the utility of structuring consumer cost-sharing and plan elements to encourage the use of high-value clinical services and providers for beneficiaries. The inclusion of clinically nuanced V-BID elements may be an effective approach to reducing the cost and improving the quality of care for Medicare Advantage enrollees.

Medicare Part D Senior Savings Model

On March 11th, 2020, CMS announced the new 2021 Medicare Part D Senior Savings Model. Beginning on January 1st, 2021, CMS will allow Medicare Part D and Medicare Advantage sponsors nationwide to offer a benefit design that includes predictable co-pays for insulin. Beneficiaries who enroll in this voluntary model will be able to receive a thirty-day supply of a broad set of plan-formulary insulins for no more than $35. Participating beneficiaries are expected to save an average of $446 per year in out-of-pocket costs relative to average cost-sharing amounts in 2020. This V-BID implementation has the potential to help millions of diabetic Medicare beneficiaries access insulin and manage their diabetes through reducing and stabilizing monthly costs.

Conclusion

Although there is urgency to bend the Medicare cost curve, it is critical for cost containment efforts to go hand-in-hand with a focus on quality. Applying clinically nuanced strategies in benefit design presents an enormous opportunity for the Medicare program. V-BID can encourage the utilization of high-value providers and services and limit the use of services that are of potentially low-value, thus helping Medicare Advantage plans improve health and quality, enhance consumer engagement, and reduce costs. Allowing MA plans to utilize value-based insurance design principles will better serve beneficiaries in the long run.

This brief is based on the May 2013 V-BIDHealth white paper, September 2015 CMS Announcement of the Medicare Advantage Value-Based Insurance Design Model Test, MA-V-BID Model Expansion, Introduction of Senate Bill to Expand V-BID Medicare Demonstration to all 50 States, and the CMS Medicare Part D Senior Savings Program Fact Sheet.

For more information, please visit the V-BID Center Medicare/Medicare Advantage Initiative webpage.