Rising Cost-Sharing

Consumer cost-sharing for medical care and medications is high and getting higher. The average deductible for employer-sponsored single coverage increased by more than 250% between 2006 and 2016, and is now nearly $1,500.1* Even after any applicable deductible has been satisfied, patients are often liable for high copayments and coinsurance.

High cost-sharing is associated with many deleterious consequences. Patients subject to greater cost-sharing tend to reduce use of services and medications – and the greater the cost-share, the greater the corresponding reduction in service use. In response to across-the-board increases in cost-sharing, many studies find that patients reduce use of both high- and low-value care in similar proportions.4,7 Increased acute care utilization and poorer health outcomes may result.

Cost-sharing can be a useful tool for payers and purchasers to encourage prudent use of health care dollars. Historically, however, cost-sharing has been “one-size-fits-all,” and has failed to distinguish between high- and low-value clinical services and therapies.

Patient Assistance Programs

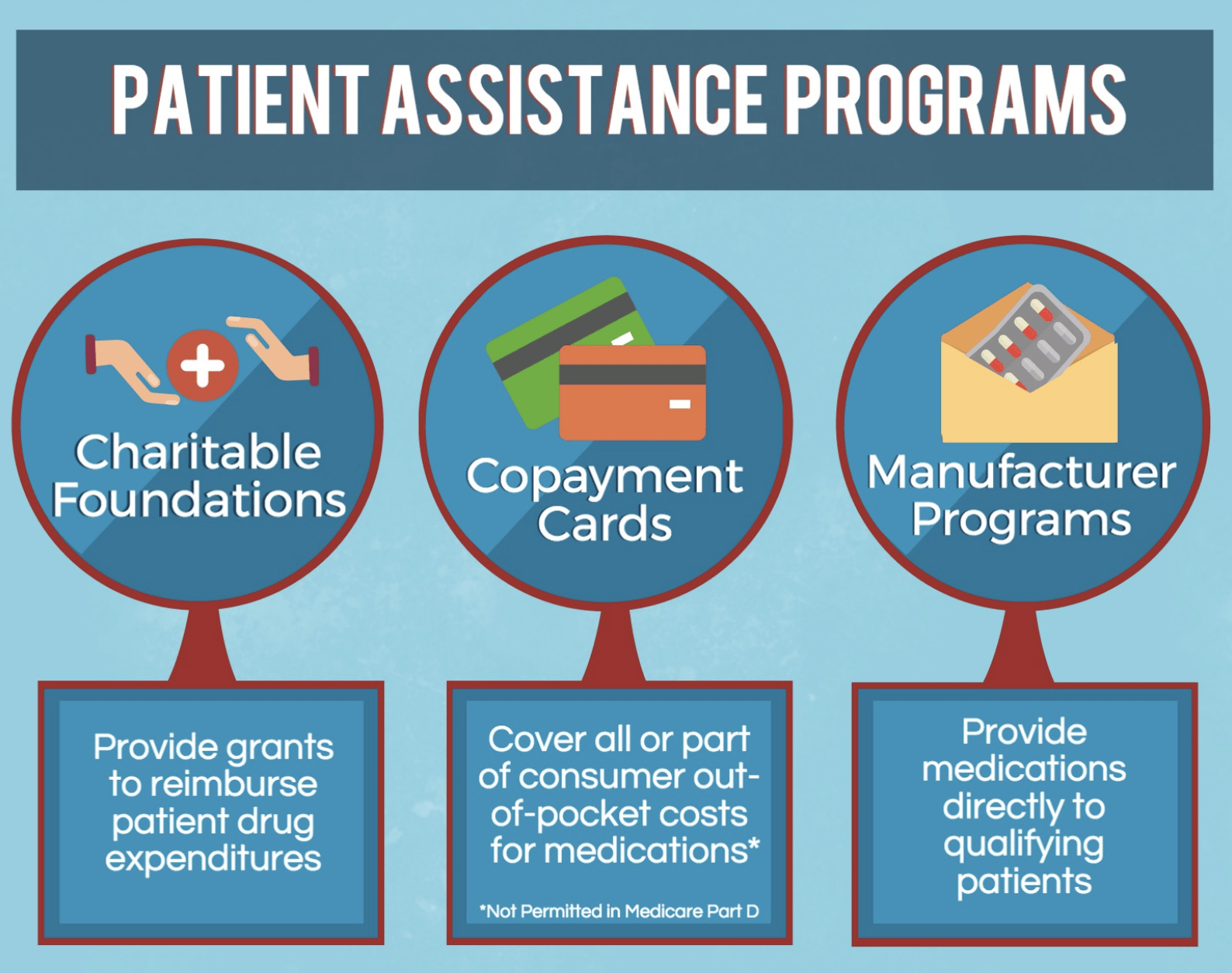

In response to the growing burden of patient cost-sharing, many copayment assistance programs have been established to help patients pay for their medical care. Patient assistance may be delivered in several forms, including copayment assistance cards (commonly referred to as “copay cards,” “discount cards,” or “savings cards”), manufacturer assistance programs, and grants from charitable patient assistance foundations.

A Growing Problem

While patient assistance programs may serve to increase access to otherwise costly prescription medications, some payers, purchasers, and researchers have expressed concerns that copay cards in particular undermine reasonable incentives for clinicians and patients to respect plan formularies and speed members toward deductibles and out-of-pocket maximum amounts they might not otherwise satisfy, thereby increasing expenditures.31–38 Use of copayment cards for branded medications when generic equivalents are available has drawn particularly harsh attention.32,33

'Competing' strategies can create a great deal of confusion and administrative burden for physicians and patients who would clinically benefit from therapies that are not easily accessible

In response to patient use of copay cards, health plans may choose to subtract assistance amounts from a patient’s deductible or out-of-pocket maximum. Since many copay cards have an annual limit on the amount of assistance a patient may receive, many patients are at risk of experiencing “sticker shock” midway through the year once the copay card’s maximum assistance amount has been reached – potentially increasing the risk of prescription abandonment and adverse health outcomes. The competing strategies of copay card programs and health plans often create a great deal of confusion and administrative burden for both physicians and patients.

Clinical Nuance in Copayment Assistance

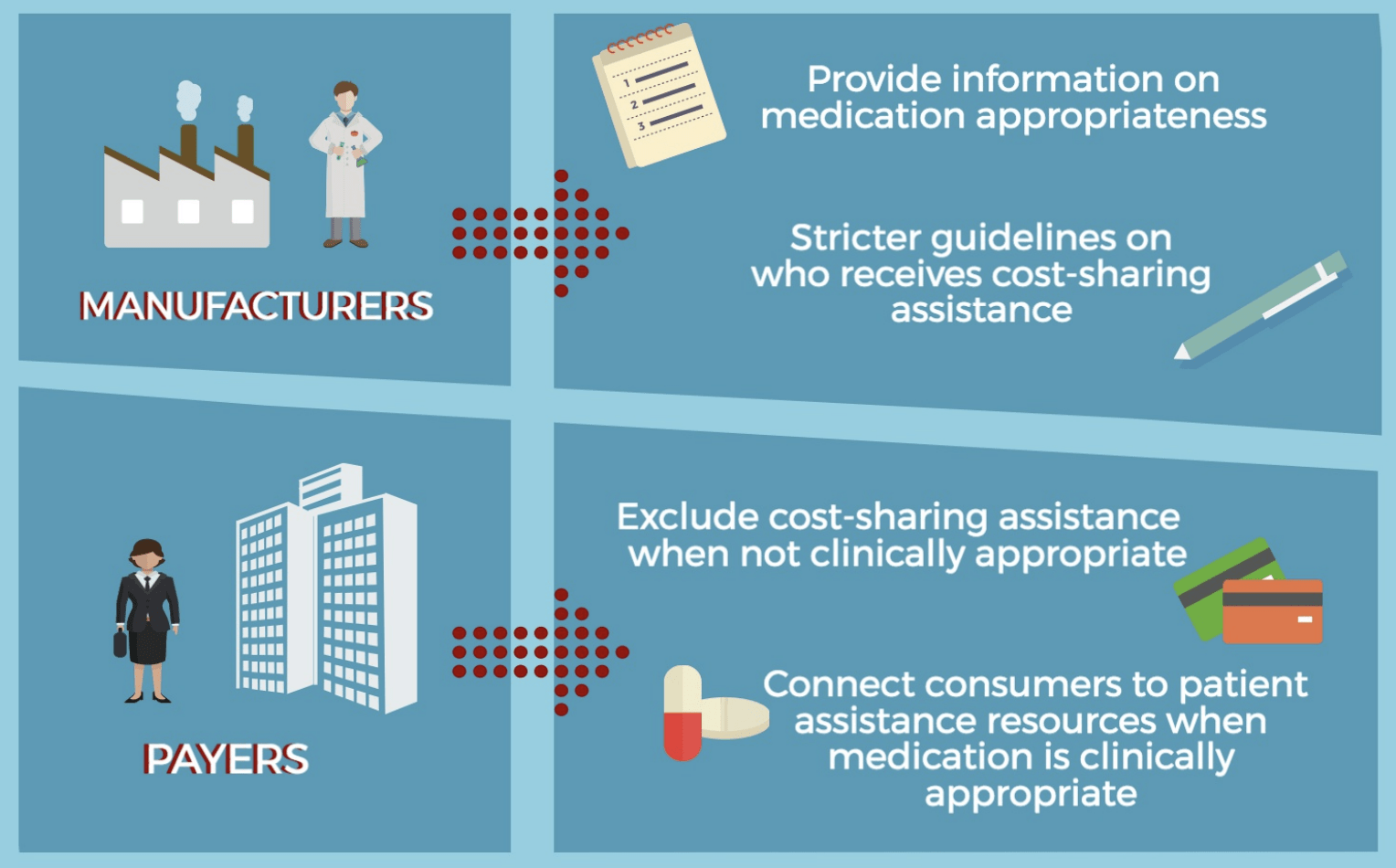

Recognizing that “one-size-fits-all” cost-sharing for high-cost medications is likely to persist, plans, pharmacy benefit managers, and manufacturers could minimize potential harm through new partnerships that facilitate the use of patient assistance when high-cost medications are used in high-value clinical scenarios. A “truce” might include the following provisions, each of which could serve to enhance access to clinically indicated therapies and decrease the financial and logistical burden on patients/families and their clinicians:Ultimately, payers and manufacturers alike have critical roles to play in enabling more seamless access to the right medication at the right time to improve the experiences of patients, families, and providers. Payers and purchasers might also benefit from some savings due to reductions in hospitalizations and emergency room visits that result from greater adherence.

*All references can be found in the Precision Co-Pay Assistance Brief below