Press Release: V-BID Highlighted at Two Congressional Hearings

The Health Subcommittee of the Congressional Committee on Ways & Means and the Joint Economic Committee held hearings on lowering health care costs and expanding access to health care. Value-Based Insurance Design principles were highlighted at both hearings as a potential cost-saving, health-improving measure.

June 6, 2018: Ways and Means Hearing on Consumer-Directed Health Plans

“How do we lower costs and expand access to health care?”

The Health Subcommittee of the Congressional Committee on Ways & Means held a hearing on lowering costs and expanding access to health care through Consumer-Directed Health Plans. Value-Based Insurance Design principles were highlighted as a promising reform to high-deductible health plans, particularly in chronic disease management and HSA rule flexibility.

Matt Eyles, President and CEO of America’s Health Insurance Plans (AHIP), highlighted that HSAs should have more flexibility. Specifically, he was in support of allowing HSAs the flexibility to incorporate value-based insurance design principles.

Matt Eyles, President and CEO of America’s Health Insurance Plans (AHIP), highlighted that HSAs should have more flexibility. Specifically, he was in support of allowing HSAs the flexibility to incorporate value-based insurance design principles.

He emphasized the lack of changes to the HSA-HDHP program over time, in comparison to similar services. He called for a shift towards more value-based coverage in HSAs.

Jody Dietel, Chief Compliance Officer at WageWorks,Inc., discussed current HSA eligibility rules, calling for increased flexibility to cover specified chronic disease services pre-deductible. Ms. Dietel also stressed the importance of making consumers more aware that preventive services are covered under the Affordable Care Act.

Congresswoman Diane Black (R-TN) stated that she is in support of expanding HSAs to cover low-cost, high-value services pre-deductible to manage chronic care. She emphasized that this would help cut health care costs long-term, through the general improved health of patients. Last February, Ms. Black and Congressman Blumenauer (D-OR) jointly sponsored the Chronic Disease Management Act of 2018 (S.2410 and H.R. 4978), which allows pre-deductible coverage of high-value services for specified chronic conditions.

June 7, 2018: Congressional Hearing on the Potential for HSAs to Engage Patients

“How do we make care better and less costly for all Americans?”

The Joint Economic Committee hosted a hearing on the potential for health care savings accounts to engage patients more effectively by expanding the “safe harbor” to better manage chronic conditions. The hearing addressed several shortcomings of HSA-HDHPs, as well as the importance of transparency in prescription medication pricing. Multiple witness testimonies put emphasis on prioritizing coverage for high-value care under HSA-HDHPs.

Kavita Patel, MD stated, “…we should be spending way more money in high-value services, but we’re not; we’re spending across the board.”

spending way more money in high-value services, but we’re not; we’re spending across the board.”

Patel also discussed how expanding the IRS “safe harbor” would increase the clinical effectiveness of HSA-HDHPs. Patel is in support of policies which allow HDHPs the flexibility to provide pre-deductible coverage of high-value services.

Mr. Kevin McKechnie, Executive Director of the HSA Council and Senior VP for the American Bankers Association, highlighted several problems with health savings accounts, pointing out how patients who have HSAs cannot access their Medicare, TRICARE, and Veterans Administration benefits pre-deductible.

Mr. McKechnie also advocated for the expansion of HSAs, stating, “HSAs should be able to cover more value-based services such as direct primary care and chronic disease management.” Mr. McKechnie supports the Chronic Disease Management Act of 2018.

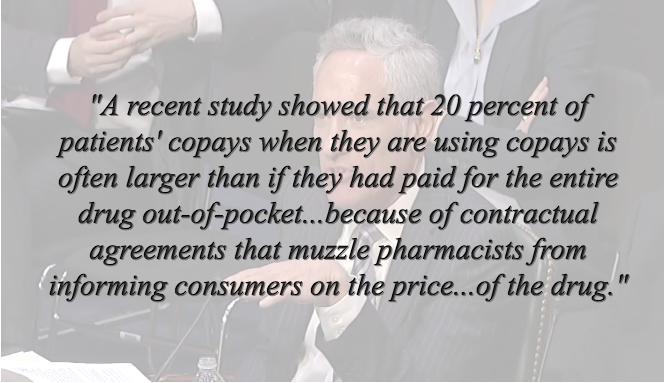

Senator Martin Heinrich (D-AZ) requested Scott W. Atlas, MD, provide analysis on increasing patient interest in prescription drug costs through price transparency.

Senator Martin Heinrich (D-AZ) requested Scott W. Atlas, MD, provide analysis on increasing patient interest in prescription drug costs through price transparency.

Atlas discussed educating patients on pre-insurance programs and on the cost of their prescription medications. He spoke on the importance of price transparency and using positive incentives to reward patients for choosing high-value, low-cost care.

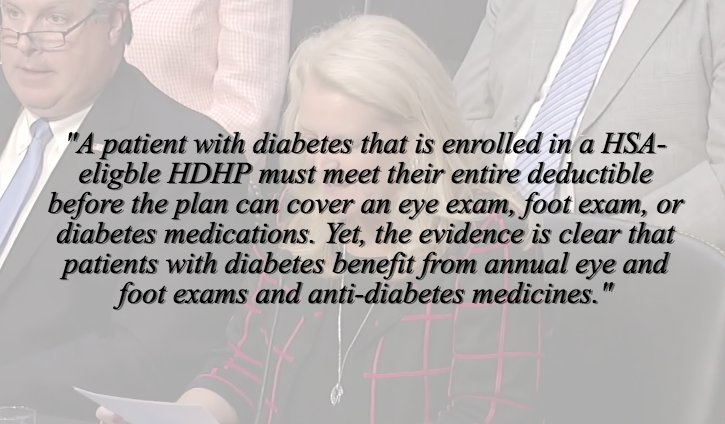

Tracy Watts, Senior Partner at Mercer and Board of Directors at the American Benefits Council, called for coverage of high-value services for patients with chronic conditions. Ms. Watts described HSA regulations that limit access to high-value care.

She specifically cited challenges faced by patients with diabetes. Under current regulations, diabetes patients must meet their entire deductible before HSA-eligible HDHPs cover high-value services, including eye exams, foot exams, and diabetes medications.

In response to the question of which essential services should be covered, Dr. Patel emphasized the importance of covering high-value services. She stated that this would ultimately drive down costs through the utilization of lower-cost, higher-value services, while low-value services drive up costs unnecessarily without added health benefits; therefore, those low-value services should be more expensive for the consumer.

To watch streams of the Congressional hearings:

Ways & Means Hearing Joint Economic Committee Hearing

For more information on V-BID and HSA-HDHPs:

HDHP+ Research 1-Pager HDHP+ Research White Paper HDHP+ Infographic HDHP+ Whiteboard Video

HDHP+ Summary HDHP+ Timeline The Hill Blog Post